Have you ever wondered why savvy investors continue to take advantage of the 1031 Tax Deferred Exchange? It’s a good question, and fortunately, there are many good answers. Aside from giving the investor a tremendous increase in purchasing power, a 1031 exchange provides the benefits of leverage, consolidation/diversification, management relief, and increased cash flow/income.

LEVERAGE

Investors can take advantage of the 1031 Tax Deferred Exchange to acquire a more valuable investment property. By utilizing the money they would have paid to the IRS in taxes, they can increase their down payment and acquire a more expensive replacement property. Thus, leveraging their cash and continuing to build wealth through real estate investment.

CONSOLIDATION/DIVERSIFICATION

With the flexibility of an exchange, an investor may exchange one property for several others, consolidate multiple properties into one, and acquire property anywhere within the United States. For example, an investor can exchange two duplexes for a retail strip center, or take advantage of a new growth area by exchanging one property in California for three properties in Arizona.

MANAGEMENT RELIEF

Investors that own several rental properties are often faced with the burdens of intensive management and costly maintenance-which often leads to increased headaches! An investor can increase profits and decrease time and effort by exchanging out of high maintenance rental properties and consolidating into an apartment building or NNN leased investment.

INCREASED CASH FLOW/INCOME

Cash flow and overall income can both be increased through a 1031 Tax Deferred Exchange. For example, a vacant parcel of land that generates no cash flow or depreciation benefits can be exchanged for a commercial building that does.

INCREASED PURCHASING POWER

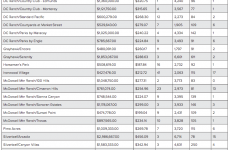

The following numbers illustrate the financial power of a 1031 exchange.

Original Cost (Basis)

$100,000

Plus Capital Improvements

20,000

Less Depreciation

35,000

Equals Adjusted Basis

85,000

Sales Price

$500,000

Less Adjusted Basis

85,000

Less Costs of Sale

40,000

Equals Capital Gain

375,000

Capital gain is taxed at a maximum capital gains tax rate of 15% and depreciation is recaptured at 25%. In this example, the total taxes due would be:

$59,750 (25% of $35,000 and 15% of $340,000) plus $35,812.50 (9.55% of $375,000 in California capital gain tax) equals $95,562.50 deferred through the 1031 tax-deferred exchange for increased purchasing power!